Enhanced Development Speed

In the context of the microservices architecture market, the emphasis on enhanced development speed is becoming more pronounced among French companies. By adopting microservices, organizations can break down monolithic applications into smaller, manageable components, which allows for parallel development. This approach not only accelerates the development lifecycle but also reduces time-to-market for new features and updates. Recent statistics suggest that companies utilizing microservices can achieve a 30% reduction in development time compared to traditional methods. This efficiency is particularly appealing in sectors where rapid innovation is crucial. As a result, the drive for enhanced development speed is a key factor propelling the microservices architecture market forward in France.

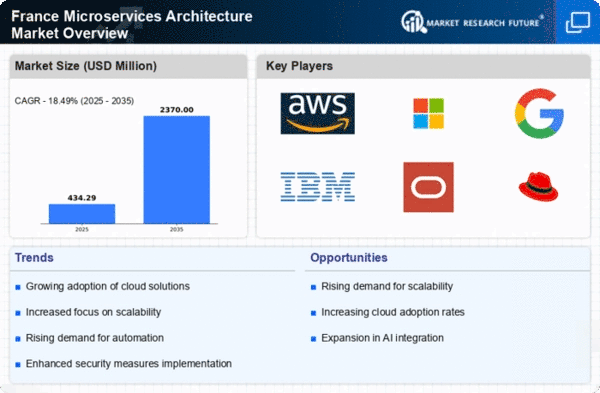

Growing Demand for Scalability

The microservices architecture market in France is experiencing a notable surge in demand for scalability solutions. As businesses increasingly seek to enhance their operational efficiency, the ability to scale applications seamlessly becomes paramount. This architecture allows organizations to deploy services independently, facilitating rapid scaling in response to fluctuating user demands. According to recent data, approximately 65% of French enterprises are prioritizing scalable solutions to accommodate their growth strategies. This trend indicates a shift towards more agile development practices, where microservices enable teams to innovate and deploy features at a faster pace. Consequently, the growing demand for scalability is a significant driver in the microservices architecture market, as companies aim to remain competitive in a dynamic business environment.

Increased Focus on Customer Experience

The microservices architecture market is increasingly influenced by the heightened focus on customer experience among French businesses. Organizations are recognizing that delivering personalized and responsive services is essential for retaining customers in a competitive landscape. Microservices facilitate this by enabling rapid iterations and updates to applications, allowing companies to respond swiftly to customer feedback and changing preferences. Data indicates that businesses that prioritize customer experience can see a 20% increase in customer satisfaction scores. This emphasis on enhancing customer interactions is driving the adoption of microservices, as companies strive to create more engaging and tailored experiences for their users. Thus, the focus on customer experience is a pivotal driver in the microservices architecture market.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver in the microservices architecture market, particularly in France, where businesses are under constant pressure to optimize their operational expenditures. By leveraging microservices, organizations can allocate resources more effectively, as they only need to scale specific services rather than entire applications. This targeted approach can lead to substantial cost savings, with studies indicating that companies can reduce infrastructure costs by up to 40% through microservices adoption. Furthermore, the ability to utilize cloud resources dynamically contributes to this cost efficiency. As French enterprises continue to seek ways to streamline their operations, the focus on cost efficiency and resource optimization is likely to sustain growth in the microservices architecture market.

Regulatory Compliance and Data Governance

In the microservices architecture market, the increasing emphasis on regulatory compliance and data governance is shaping the landscape for French enterprises. With stringent regulations such as GDPR in place, organizations must ensure that their applications adhere to legal standards while managing data effectively. Microservices architecture offers a modular approach that can simplify compliance efforts, as individual services can be designed to meet specific regulatory requirements. This adaptability is crucial for businesses aiming to mitigate risks associated with non-compliance. Recent surveys indicate that approximately 70% of French companies view compliance as a top priority in their IT strategies. Consequently, the focus on regulatory compliance and data governance is a significant driver of growth in the microservices architecture market.